India is entering a new era of consumer wealth and aspiration. As disposable income surges across metro cities and emerging regions alike, a powerful segment of high value consumers is reshaping spending trends, luxury demand, and investment behavior.

According to recent market studies, India is expected to have over 10 million HNIs (High Net-Worth Individuals) by 2025, driven by rapid digital entrepreneurship, startup exits, and the growing upper-middle class. These consumers are not just wealthy—they’re digitally connected, experience-driven, and regionally diverse.

In this article, we dive deep into regional insights, sector-wise spending, and behavioral trends of India’s high value consumers in 2025—helping businesses, marketers, and data professionals understand where the real opportunities lie.

1. Defining India’s High-Value Consumers

High-value consumers, often categorized as HNIs and UHNWIs, are individuals or business owners with significant disposable income and strong purchasing intent.

They typically:

- Earn or control assets above ₹50 lakh–₹2 crore annually

- Make frequent high-ticket purchases (luxury cars, property, tech, and travel)

- Are decision-makers in business or professional roles

- Prioritize experience, quality, and brand trust over price

In 2025, this segment will play a pivotal role in driving India’s luxury, investment, and B2B service industries.

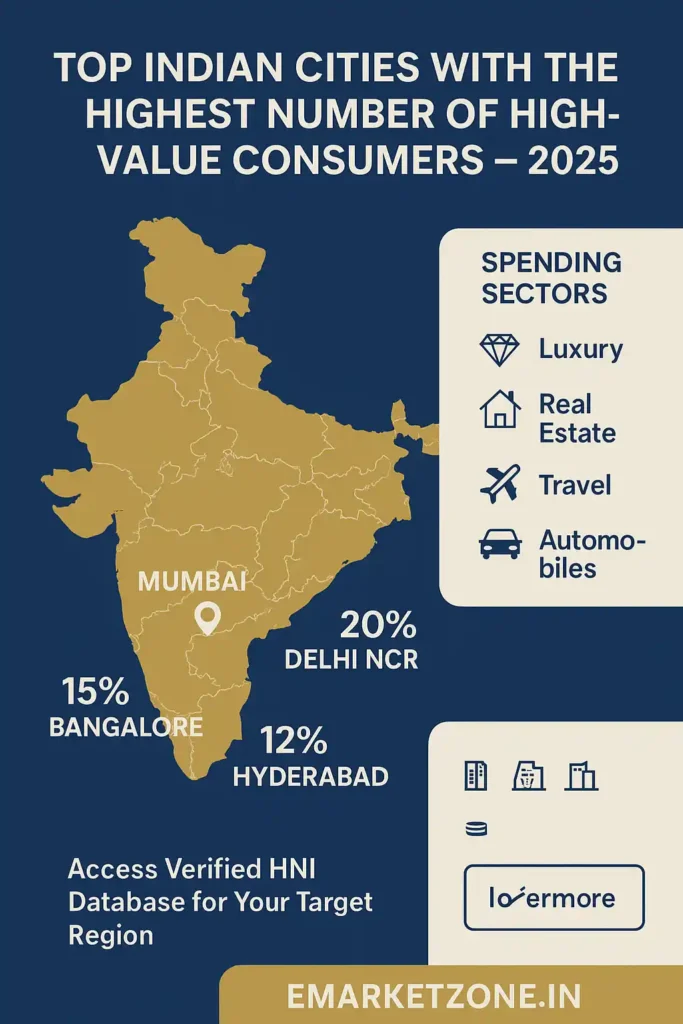

2. Regional Insights: Where India’s Wealth Is Concentrated

Metro Powerhouses

Cities like Mumbai, Delhi NCR, Bengaluru, and Hyderabad continue to dominate India’s wealth map.

- Mumbai: Hub of finance, real estate, and luxury retail

- Delhi NCR: Dominant in high-end services, startups, and policy influence

- Bengaluru: Tech founders and startup millionaires driving digital wealth

- Hyderabad: Rapidly growing due to IT exports and real estate expansion

Tier-2 & Tier-3 Growth

A surprising trend in 2025 is the rise of Tier-2 cities like Pune, Surat, Indore, Lucknow, and Coimbatore.

These cities are seeing:

- More SME business owners entering the high-value bracket

- Rising property investments and online luxury purchases

- Strong adoption of fintech and digital wealth platforms

Regional Data Insight Snapshot:

| Region | Key Wealth Driver | Spending Focus |

|---|---|---|

| West (Mumbai, Pune, Surat) | Finance, Real Estate, Manufacturing | Luxury Homes, Automobiles |

| North (Delhi, Chandigarh, Lucknow) | Policy, Services, Trade | Fashion, Travel, Lifestyle |

| South (Bengaluru, Chennai, Hyderabad) | IT, Startups, Exports | Gadgets, Experiences, Global Brands |

| East (Kolkata, Bhubaneswar, Guwahati) | MSME, Trade, Exports | Education, Property, Savings |

3. Spending Trends of India’s High Value Consumers (2025)

India’s HNIs are no longer spending for status—they’re spending for convenience, legacy, and lifestyle elevation.

Key Sectors:

- Luxury & Lifestyle: Premium apparel, watches, and automobiles are thriving.

- Travel: Rise in international travel to Europe, Japan, and Middle East.

- Tech: Surge in high-end gadgets, smart homes, and EV adoption.

- Education: Parents investing heavily in international schooling.

- Real Estate: Preference for second homes and gated luxury communities.

- Investment: Digital gold, startups, and alternative assets are gaining traction.

Digital Behavior

- 78% of high-value consumers research brands online before purchasing

- 60% follow luxury influencers or business creators on Instagram & LinkedIn

- 45% engage directly with personalized ad campaigns and email funnels

Businesses targeting luxury, finance, or real estate buyers can access verified High-Value Consumer Data segmented by region, and profession to refine their campaigns.

4. How Businesses Can Leverage HNI Data in 2025

Whether you’re in real estate, finance, luxury retail, or B2B services — understanding where and how high-value consumers spend is the key to scaling profitably.

Here’s how a verified HNI dataset from EMarket Zone can help:

- 🎯 Target Precisely: Segment by city, income range, and occupation.

- 💬 Personalize Campaigns: Tailor your ad creatives and messaging.

- 📈 Boost Conversions: Reach audiences already primed to spend.

- 🧠 Expand Strategically: Identify new wealth clusters in Tier-2 cities.

In short, HNI data transforms guesswork into data-driven targeting and measurable ROI.

Want to Reach India’s Wealthiest Audience?

Access verified and segmented HNI Consumer Data to boost your ROI.

Explore the HNI Database →

5. The Future of India’s High-Value Market

By 2025, India’s luxury and investment sectors are expected to grow by over 12% CAGR, fueled by:

- Global brands entering India’s premium market

- Increasing NRI and tech-founder wealth

- Digital transformation in financial services

Businesses that adapt early — by using consumer intelligence and verified datasets — will have a competitive edge in reaching India’s next billion-dollar demographic.

Conclusion: Data is the New Luxury

The future of sales and marketing belongs to those who understand their audience deeply.

India’s high value consumers are not just buying — they’re shaping industries.

With verified HNI and high-value consumer data, brands can connect meaningfully with this elite audience, craft smarter campaigns, and grow faster in 2025 and beyond.

Leave a comment